Tesla’s India Entry: A Game Changer or an Uphill Battle?

After years of speculation, Tesla is finally making its move into India. The American EV giant has begun hiring for multiple positions in Delhi and Mumbai while also scouting for showroom locations in these cities.

Why India? The Growth Potential Amidst Global Challenges

With global EV sales slowing and Chinese competitors intensifying their grip on the market, Tesla sees India’s growing EV sector as a fresh opportunity. As the world’s third-largest economy, India presents an exciting but complex landscape for Tesla’s futuristic vehicles.

However, the real question remains: Can Tesla thrive in India’s price-sensitive market?

Price Wars: Tesla vs. Homegrown EV Giants

Tesla will be entering a market where affordability drives demand. Currently, Tata Motors dominates the Indian EV segment with a 60% market share, followed by MG Motors (22%) and Mahindra. These companies offer EVs at half the price of Tesla’s base model, which is expected to cost around $40,000 (₹33 lakh)—firmly placing Tesla in the luxury segment.

This pricing puts Tesla in direct competition with premium EVs from BMW, Mercedes, and Hyundai, rather than mass-market vehicles. Unless Tesla introduces a budget-friendly model tailored for India, its reach may remain limited to high-end consumers.

India’s Road Challenges: Is Tesla Ready?

Another potential hurdle is India’s road conditions. Tesla cars have low ground clearance, which makes them less suited for India’s bumpy roads, potholes, and speed breakers. For Tesla to truly adapt, its models may need engineering modifications—a costly endeavor for a market where sales volumes might remain relatively low.

Charging Infrastructure: A Long Road Ahead

India’s EV ecosystem is still in its early stages, with EVs accounting for less than 3% of total passenger vehicle sales. While charging infrastructure is expanding, India currently has only 25,000 charging stations—a fraction of what’s needed for a widespread EV boom.

Tesla’s Dilemma: Luxury Status or Mass Adoption?

For Tesla to succeed in India, it faces two choices:

- Stick to its premium pricing strategy, catering to niche luxury buyers.

- Develop a more affordable model tailored for India, which could drive mass adoption but require major cost adjustments.

While Tesla’s brand power and technology will certainly attract attention, its success in India will depend on how well it adapts to local challenges—pricing, infrastructure, and road conditions.

Will Elon Musk take the long road to mass-market dominance or settle for a small luxury footprint? That remains the billion-dollar question.

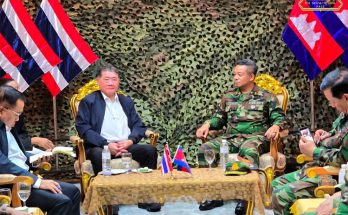

Tesla CEO Elon Musk (left) met Indian Prime Minister Narendra Modi in Washington DC last month

India’s EV Push: A Golden Opportunity for Tesla?

At a policy level, India is rolling out the red carpet for Tesla and other global EV manufacturers, aligning with its ambitious electrification goals. By 2030, the country aims for:

- 30% of private cars to be electric

- 70% of commercial vehicles to run on electricity

- 40% of buses to transition to EVs

- 80% of two- and three-wheelers to be battery-powered

Government Incentives: A Strong EV Boost

India isn’t just talking big; it’s backing its EV ambitions with massive subsidies. According to HSBC Securities, India offers some of the highest EV subsidies globally—covering up to 46% of the price of the country’s top-selling electric cars. This aggressive push has led to a 2,000% surge in EV sales in just five years—from 4,700 units annually to over 100,000.

The key driver? Shrinking price gaps between traditional fuel-powered cars and EVs, making the switch more appealing for consumers.

Tesla’s Big Break: Import Tax Cuts & Localization Deals

To further entice global players like Tesla, India introduced a game-changing policy in April 2023, slashing import duties on high-end EVs for companies that commit to investing $500 million and local production within three years.

Under this policy:

- Tesla and other imported EVs above $35,000 can now enter with just a 15% import duty (down from the previous 100% tax).

- This exemption applies to up to 8,000 vehicles annually—giving Tesla a fast-track entry into the market.

This move came after Elon Musk repeatedly criticized India’s steep import tariffs, which he claimed made Tesla’s entry unfeasible. Now, the playing field has changed, and Tesla has an open door to test the waters before committing to full-scale manufacturing.

A Strategic Win—But a Challenge for Domestic Automakers?

Industry experts, including Hormazd Sorabjee, see this policy as a smart strategic play:

However, not everyone is thrilled. HSBC warns that this policy could put Indian automakers at a disadvantage. While foreign brands like Tesla can enter with relatively low investment commitments, domestic EV makers have already poured billions into infrastructure and R&D under far stricter conditions.

Moreover, Tesla’s 15% import duty is significantly lower than what fuel-powered cars face in India, which also pay additional road taxes. This could create an uneven competitive landscape, favoring imported EVs over local combustion-engine cars.

The Road Ahead: Tesla’s Next Move in India

With government incentives, a growing EV market, and now a tax-friendly entry path, Tesla finally has a real shot at India. However, challenges remain:

- Will Tesla set up manufacturing in India to fully capitalize on local demand?

- Can it compete with price-sensitive Indian consumers, or will it remain a luxury niche player?

- Will the infrastructure—charging stations, supply chains—scale up fast enough to support mass Tesla adoption?

India is offering Tesla an unprecedented opportunity, but success will depend on how well it adapts to the realities of this dynamic and complex market. The next few years will be crucial in determining whether Tesla thrives—or merely tests the waters—in the world’s fastest-growing auto market.

Tesla’s India Entry: A Luxury Symbol or a Manufacturing Powerhouse?

As Tesla prepares to enter India, domestic EV makers are keeping their cool, emphasizing that a “level playing field” is important but welcoming competition nonetheless.

Indian EV Makers Brace for Tesla’s Impact

Mahindra & Mahindra’s CEO, Rajesh Jejurikar, believes Tesla’s entry will strengthen India’s EV ecosystem, pushing all players to improve their offerings. Key concerns like “range anxiety”—whether an EV’s battery will last a full journey—are being tackled through robust battery integration and real-world testing.

However, Tesla still holds a strong edge in battery technology, software, and user experience. As Hormazd Sorabjee points out, Tesla’s sturdier batteries, superior range, and cutting-edge interface will set it apart in the Indian market.

The Premium Car Boom: A Boost for Tesla?

Tesla’s timing could work in its favor. India’s luxury vehicle segment is expanding, driven by a young, affluent population that views Tesla as a “cool” status symbol. For many, owning a Tesla won’t just be about efficiency—it’ll be about prestige.

But while India’s pro-EV policies and rising demand for premium cars make the country an attractive market, Tesla still hasn’t committed to local manufacturing.

Manufacturing Uncertainty: Will Tesla Build in India?

For now, Tesla appears set to ship cars from its overseas factories, rather than invest in an Indian production facility. Whether that changes will depend on:

- The growth of India’s premium consumer base

- The final tariff structure post-trade negotiations with the US

The Trump Factor: A New Roadblock for Tesla’s India Ambitions?

Former US President Donald Trump has already expressed opposition to Tesla potentially setting up a factory in India, arguing that it would be “unfair” to the US. His “America First” policy could put pressure on Elon Musk to prioritize American jobs over foreign investments.

The Road Ahead: Tesla Showrooms, But No Factories (Yet)

For now, it looks like India will first see Tesla’s luxury showrooms rather than job-creating factories. While Tesla’s arrival will undoubtedly shake up the premium EV market, its long-term commitment to India remains uncertain. The real test will come when Tesla decides whether to go all-in with local production—or remain a niche luxury import.